When your driver’s license is suspended, it can feel like a difficult road to navigate. Losing your ability to legally drive might create challenges in your daily life. However, there is a lot more to think about than just how to get around without a car. One of the most important things to consider after a license suspension is how to file insurance. Many drivers don’t realize that their insurance situation can change when their license is suspended. It’s important to know what steps to take, what options you have, and how to stay protected moving forward. At, Willis Law Firm, we are here to guide you through the legal process and help you navigate the complexities of your case.

Understanding License Suspension and Its Impact on Insurance

When your license is suspended, it means that the state has taken away your legal right to drive. This can happen for several reasons. Maybe you were caught driving under the influence. Maybe you received too many tickets. Or perhaps you didn’t pay fines related to traffic violations. No matter the reason, a suspension can create real problems, especially when it comes to insurance.

Most insurance companies view a suspended license as a big risk. If you are seen as a high-risk driver, your insurance rates might go up. In some cases, your insurance company could even cancel your policy. This could leave you in a tough spot. Even if you can’t drive, you still need insurance if you want to keep your car. So, what can you do to make sure you stay covered while your license is suspended?

Filing SR-22 Insurance After License Suspension

In some cases, after your license is suspended, you will need to file a form called an SR-22. This form proves that you have the proper insurance coverage. If your state requires an SR-22, you will need to get one from your insurance company before you can get your license back.

An SR-22 is not an insurance policy. It’s simply a form that shows you have the right amount of insurance. However, not all insurance companies offer SR-22 coverage. This means that if your current insurer doesn’t provide SR-22 forms, you might need to switch to another company. It’s also important to know that if you need an SR-22, your insurance rates will probably go up. This is because drivers who need SR-22 forms are usually considered high-risk.

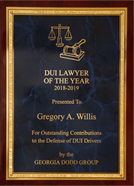

He's the only lawyer in the State of Georgia to ever be recognized for all three of these accomplishments. Received the Samurai Lawyer Award for having gone to jail for a total of 4 days in order to save his own client Received the BadAss Lawyer Award for the biggest impact of all DUI lawyers in DUI defense in the country Received the vote of Georgia Lawyers as a Superlawyer in DUI Law for 10 straight consecutive yearsGreg Willis has been successful at defending DUI cases (over 93% without a conviction)

Shopping for Insurance After a License Suspension

If your insurance policy is canceled after your license is suspended, or if your rates go up too much, you may need to shop for a new policy. Finding insurance after a suspension can be tricky, but it’s not impossible. There are many insurance companies that offer policies to high-risk drivers. The key is to compare quotes from different companies to find the best deal.

When you are looking for a new policy, make sure to ask about SR-22 coverage if you need it. Also, be prepared to answer questions about why your license was suspended. Your new insurance company will likely want to know the details of your suspension before they offer you a policy. Keep in mind that even though your rates may be higher at first, you can work towards lowering them over time. By staying insured and avoiding further violations, you can eventually improve your driving record and lower your insurance costs.

Maintaining Insurance Without Driving

Even if you aren’t allowed to drive because of your suspension, it’s still important to maintain insurance. In fact, keeping insurance during your suspension can help you avoid even bigger problems later on. If you let your insurance policy lapse, you could face penalties when you try to get your license back. In some cases, you might have to pay fines or go through extra steps to prove that you have proper coverage.

Additionally, if your car is still in your name, you’ll want to keep it insured to protect it from damage or theft. Some insurance companies offer non-owner policies, which provide coverage even if you don’t currently own or drive a car. This type of policy can be useful if you need to meet the requirements for an SR-22 without insuring a specific vehicle. Non-owner policies tend to be less expensive than traditional policies, so they might be a good option if you’re not driving during your suspension.

Getting Your License Back: Insurance Requirements

Once you’ve gone through the steps to satisfy your license suspension, getting your driving privileges back isn’t as simple as just paying a fine or serving your suspension period. In most cases, you’ll need to meet certain requirements before you can drive again, and one of those requirements is having the right insurance in place.

If you were required to file an SR-22, you’ll need to keep that in place for a set period, often a few years, depending on your state’s rules. During this time, you’ll need to keep continuous insurance coverage. Any lapse in your insurance could result in your suspension being reinstated, so it’s crucial to stay on top of your payments and keep your policy active.

Before you can reinstate your license, you may also need to show proof of insurance. This could involve providing documents from your insurance company to prove that you have the required coverage. Make sure you understand your state’s requirements and work with your insurance company to gather any necessary paperwork.

What to Do if You Can’t Afford Insurance After Suspension

Insurance rates after a suspension can be high, and this might make it difficult to afford the coverage you need. If you find yourself struggling to pay for insurance, there are a few options you can explore.

First, consider looking for insurance companies that specialize in high-risk drivers. These companies often offer more affordable rates to drivers with a suspended license. You can also ask your current insurer if they offer payment plans that allow you to pay your premium in smaller amounts over time.

Another option is to explore state programs that help drivers with suspended licenses. Some states offer financial assistance or special insurance programs for high-risk drivers. These programs can help make insurance more affordable while you work to get your license back.

Related Videos

Choosing a Georgia DUI Attorney

Defenses and Strategies to Defend a DUI Charge

Driving Safely After a License Suspension

Once you’ve gone through the process of getting your insurance and license back, it’s important to make sure that you avoid future issues that could lead to another suspension. Driving safely and following all traffic laws is the best way to protect your driving record and keep your insurance rates manageable.

Make sure to stay aware of the rules of the road and avoid behaviors that could put you at risk of another suspension, like speeding or driving under the influence. Remember that your driving history will continue to impact your insurance rates, so maintaining a clean record is in your best interest.

Over time, as you show that you’re a responsible driver, your insurance rates will likely start to go down. By avoiding further violations and keeping up with your insurance payments, you can gradually rebuild your driving record and reduce the financial burden of being a high-risk driver.

The Role of Legal Assistance After a License Suspension

Navigating the insurance process after a license suspension can be complicated, especially if your situation involves more serious issues like DUI charges or multiple traffic violations. In some cases, working with a legal professional can help you better understand your options and guide you through the process of restoring your driving privileges.

Protecting a Professional License After a DUI and Refusal of a Blood Test Result: DUI Dismissed with No Jail Time and No Loss of License Challenging Admissibility of a .19 BAC Blood Test and Field Sobriety Evaluation Result: No Jail Time, No DUI on Record, No License SuspensionFeatured Case Results

A lawyer can help you understand your rights, review your case, and provide advice on how to deal with your insurance company. They can also assist you with any legal challenges you might face as a result of your suspension, such as court hearings or appeals.

While it’s possible to handle the insurance process on your own, having legal support can make the process smoother and less stressful. If you’re feeling overwhelmed by the steps involved in getting your license back and securing insurance, reaching out for help can make all the difference.

If you’re dealing with a license suspension and need help navigating the insurance process, Willis Law Firm is here to assist you. Our team has the experience to guide you through the legal challenges associated with a suspended license and help you get back on the road. Whether you need advice on filing insurance or assistance with legal matters, we are ready to support you every step of the way. Contact Willis Law Firm today to get the guidance you need to move forward with confidence. Reach out to us by phone or visit our office to discuss your case and learn how we can help you.